At the current time community property states consist of arizona california idaho louisiana nevada new mexico texas washington and wisconsin.

Joint revocable living trust texas.

Group legal plans are administered by legal access plans l l c legalease or the legalease group houston texas.

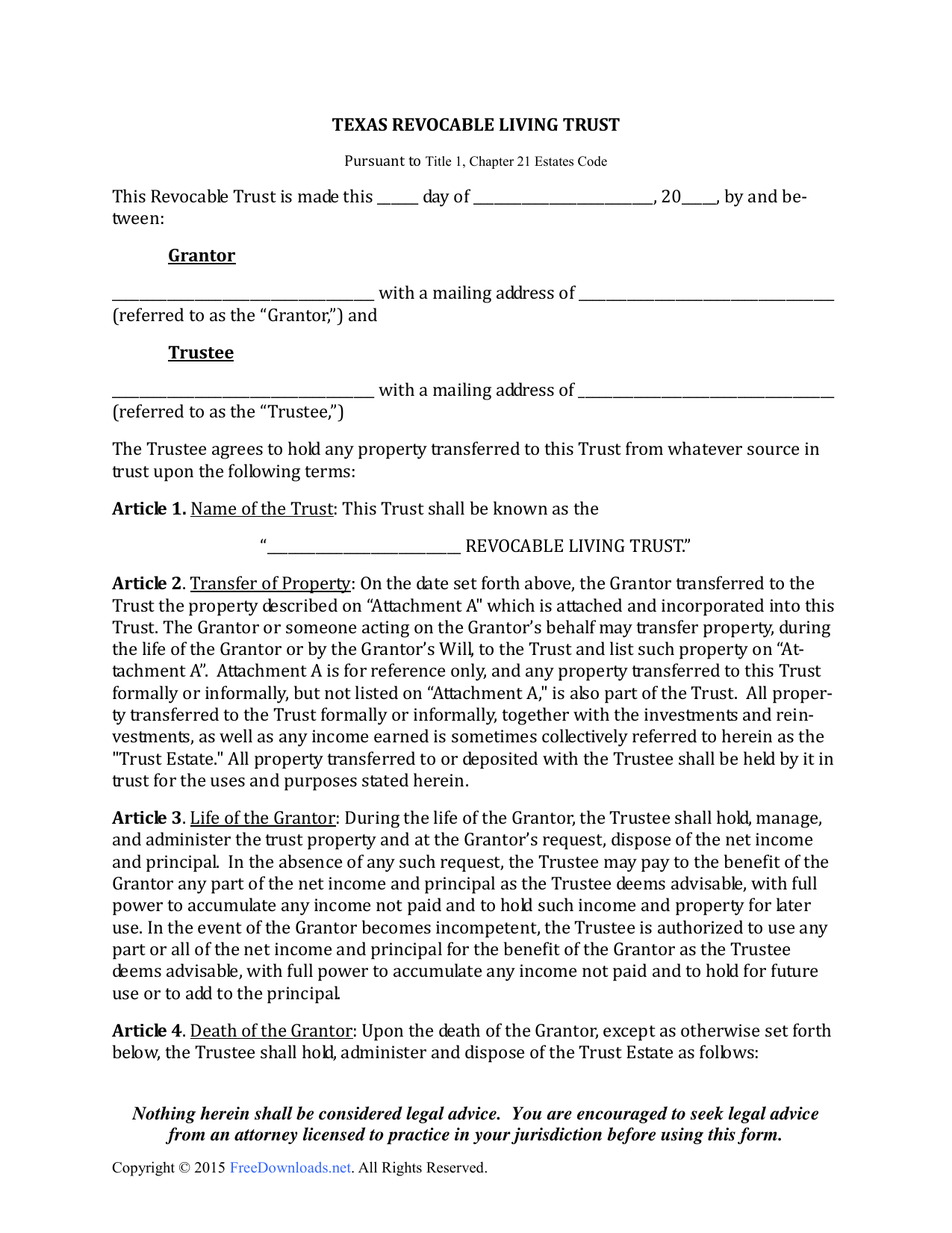

A unless the terms of the trust provide otherwise if a trust is created and amendable or revocable by the settlor or by the settlor and the settlor s spouse chapter 255 estates code applies at the settlor s death to the construction and interpretation of at death transfers as if the settlor of the trust is the testator the beneficiaries.

While many attorneys swear by one trust over the other there are many factors such as the state in which the couple resides the total of their marital estate and the couple s relationship itself that contribute to the decision of which trust is.

From a tax point of view joint living trusts are much better than individual living trusts if the trust is financed with community property.

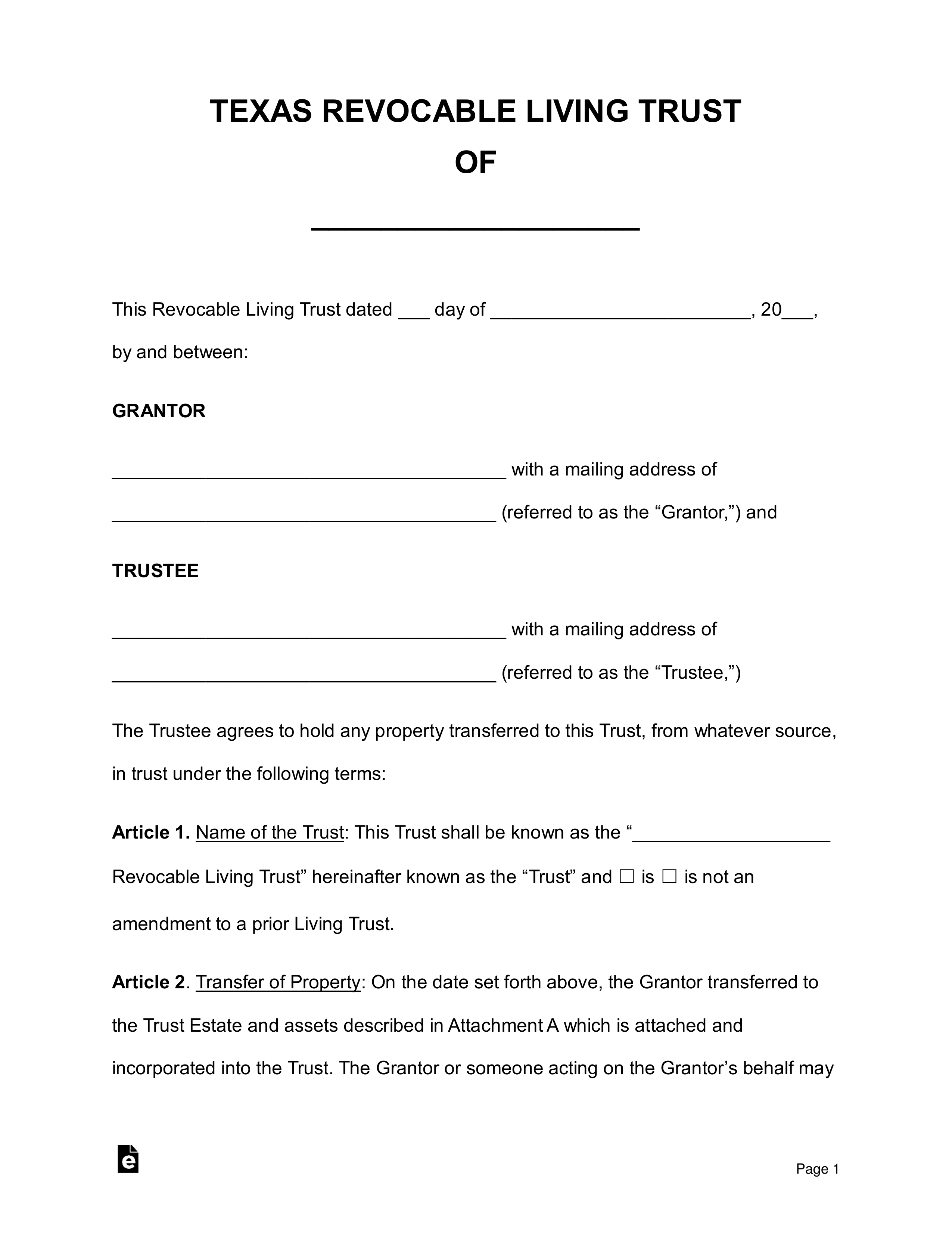

During the process of creating a living trust the grantor will transfer ownership of their property and assets into the trust.

When most people speak of a living trust they mean a revocable trust created during the creator s lifetime for the management and disposition of all or substantially all of the creator s property.

Joint trusts probably shouldn t be used between couples in a common law marriage or alternative lifestyle couples.

Underwritten by nationwide mutual insurance company and affiliated companies in all states.

A joint revocable trust can be a valuable estate planning tool for you and your spouse.

Deciding between joint and separate trusts for married couples has been a conundrum within the estate planning community for a long time.

The option of creating the marital trust at the death of the first.

Limitations and exclusions apply.

Products available in all states.

A living trust may be revocable changeable by the creator prior to his or her death or irrevocable unchangeable by the creator.

So technically the one trust document creates a joint revocable living trust and then a separate trust for the husband and a separate trust for the wife.

The texas revocable living trust is more commonly employed than an irrevocable living trust as a tool for managing a person s estate the reason being that a revocable living trust can be altered or revoked by the grantor at any time as their circumstances may change.

A living trust in texas allows you to use your assets during your lifetime and securely transfer them to your beneficiaries after your death.

The use of a joint revocable living trust as the primary estate planning instrument can be appropriate for certain married couples whose assets are uncomplicated and whose combined estates are not subject to the estate tax.

The trust can only impact assets that are placed into it so for the document to be effective you must take this step which can include changing the deed or title for real property or changing the name on bank accounts to that of the trust.

Living trusts in texas.