The arizona living trust is a document that allows a person to place personal property and or real estate in a holding the enables the beneficiary ies to bypass the probate process after the trust creator s death.

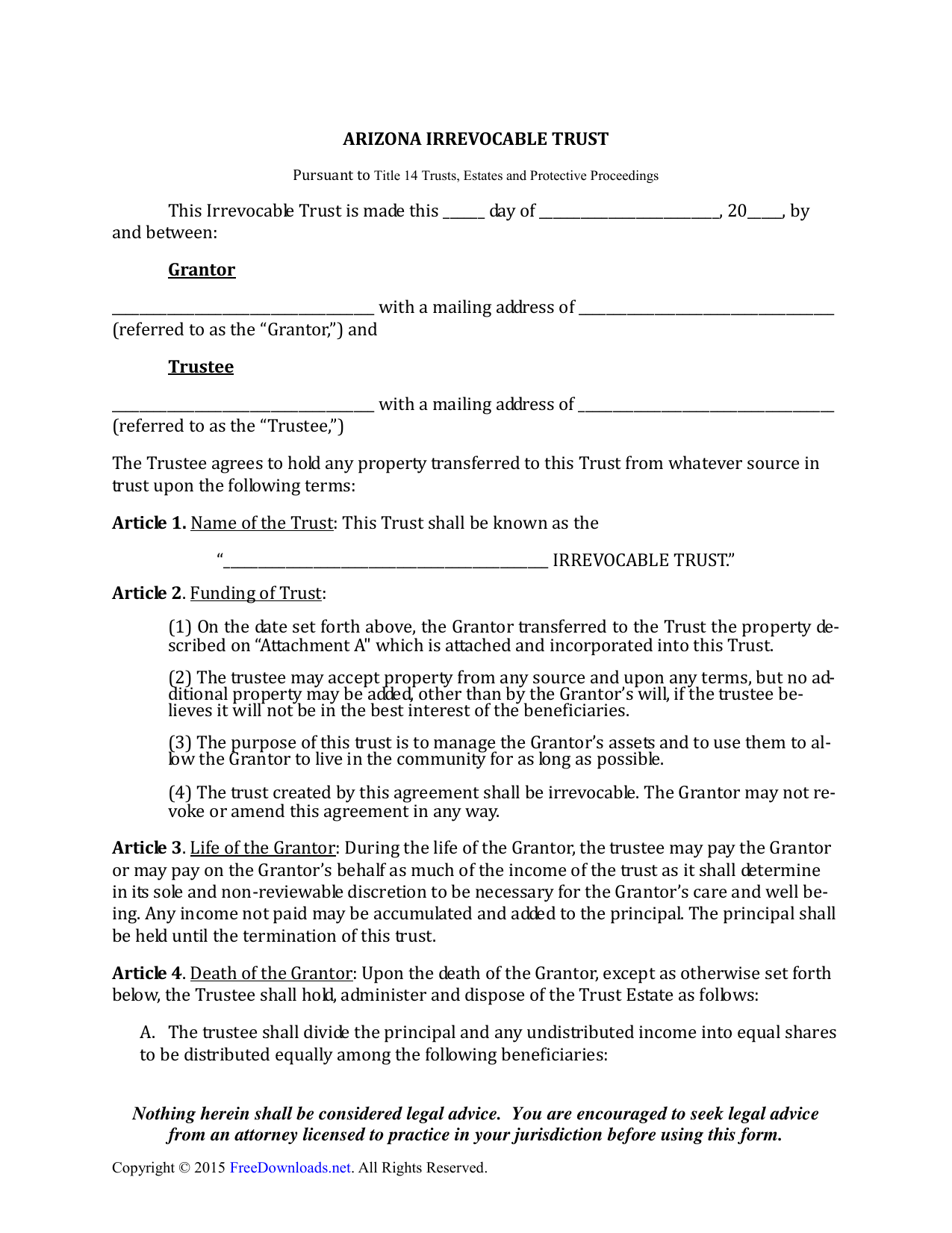

Irrevocable living trust arizona.

A revocable living trust allows you to change or cancel the trust at any point during your life while an irrevocable living trust becomes permanent.

Creating a living trust in arizona allow you to pass on your assets without having to go through the probate process.

Irrevocable trusts cannot be terminated after they are finalized.

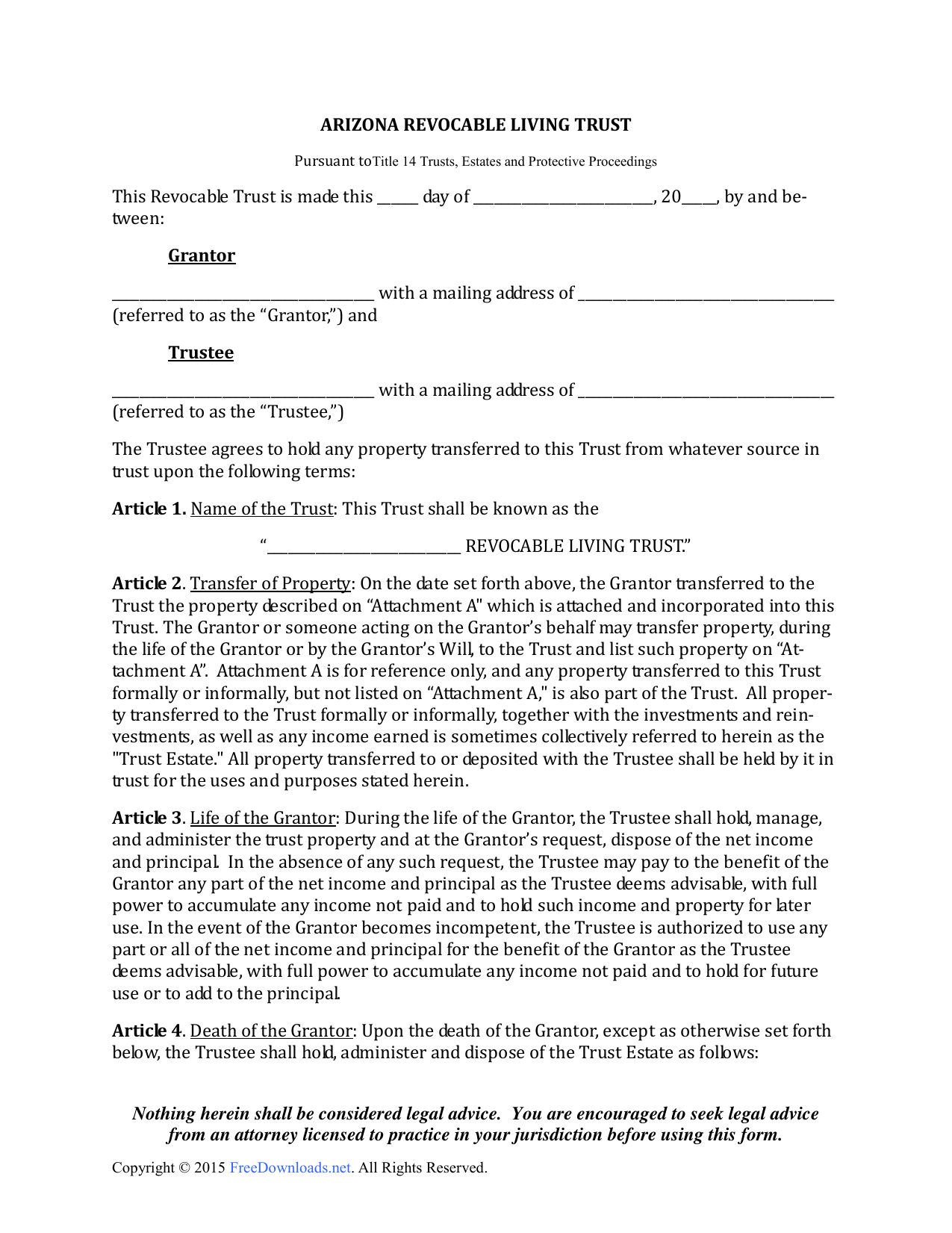

Arizona revocable living trust form.

Some irrevocable trusts include clauses that allow modifications to be made at the discretion of the beneficiary see ars 14 10411 for arizona but only if the proper clauses were included in the trust documents.

If you have an irrevocable trust or are a beneficiary of an irrevocable trust you should be aware of important provisions contained in the arizona trust code.

While the code went into effect january 1 2009 many people are still unaware of the significant changes and the requirements it imposes on irrevocable trusts.

Download the arizona irrevocable living trust form which allows you as the grantor to transfer your property into a new entity called an irrevocable trust.

This sets them apart from revocable trusts which can be terminated at least until they become irrevocable at the death of the trust maker the grantor.

Download the arizona irrevocable living trust form which allows you as the grantor to transfer your property into a new entity called an irrevocable trust.

Legal expectations of trust beneficiaries.

Per state law they must be informed by the trustee within 60 days that a trust has moved from revocable to irrevocable.

Arizona irrevocable living trust form.

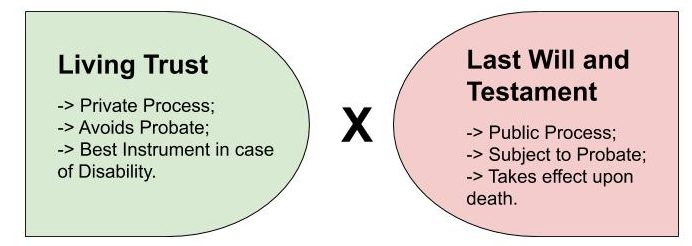

Unlike a will the contents of a living trust don t have to be distributed in probate and are not made public record.

Although arizona uses the uniform probate code a trust allows a speedy.

Generally it is extremely difficult if not impossible to alter an irrevocable trust.

The creator or grantor may still reap the benefits of the assets held within the trust during their lifetime and in the case of a revocable trust they can designate.

If you are at risk for either of these usually entrepreneurs whose personal credit and liability are tied to their business an irrevocable trust may be a better solution since assets in an irrevocable trust are separate from your personal estate.

To learn more about revocable trusts go here when talking about trusts the term living means that the trust goes into effect during the grantor s life.

The arizona revocable living trust is a document created by an individual who wishes to protect their assets and leave instructions for an appointed trustee to distribute assets to beneficiaries when they die.

Ownership of the assets are transferred to the trust but the.

This trust is administered by a trustee adobe pdf.